Get In Touch

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge

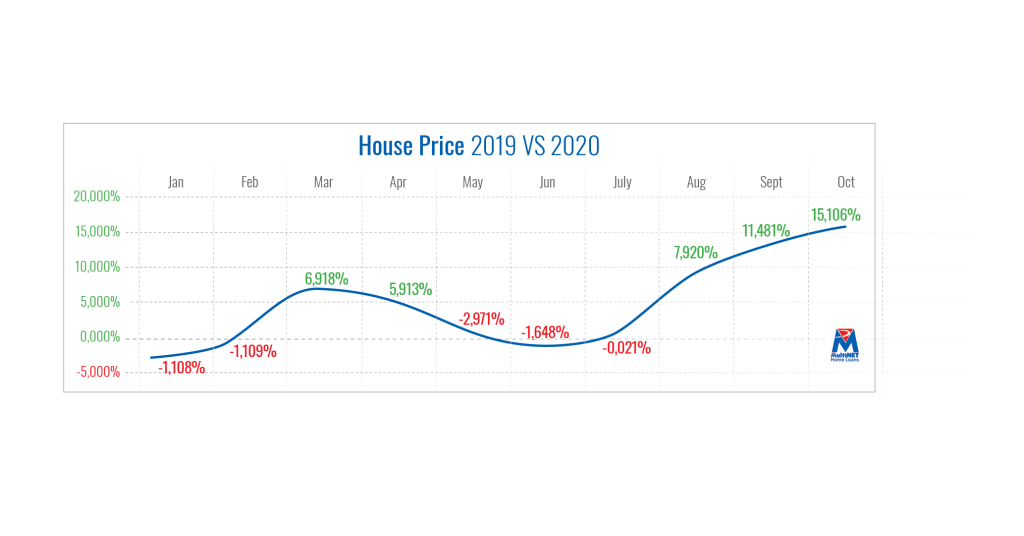

Johannesburg, 18 November 2020 – Multinet Home loans has seen a double-digit growth in average approved loans in 2020 vs 2019.

In October 2019, the average approved loan was R949 200.49 compared to 2020’s of R1 092 587.08 while October’s house price growth was 15.106%. The reason Rademeyer says is supply and demand; many consumers have now been able to afford property with the low interest rate, however with the Banks providing payment holidays to many consumers, stock has become low for real estate agents, and consumers are also holding onto their properties.

Before SA went into hard lockdown the housing market was showing a steady increase in bank competitiveness, this resulted in higher loan to values being granted and first-time buyer propositions were becoming more prevalent by the majors SA Banks. We could see this with an increase in accepted bond grant rate of 56.89% compared to the previous year average of 52%, March’s price increase followed on from the recovery we were seeing until the country went into lockdown.

What we observed in May, June and July was a decrease in property prices, many sellers decided to accept the lower offers they were getting as buyers used the convid-19 dilemma as a bargaining tool. However, with the reduction in interest rates the market opened up to a new set of consumers that would be able to afford a property for the same prices as they were renting and a clear increase in first-time buyers was noted. The result was a high demand cycle with a relatively low supply, which resulted in approved bond prices / home prices increasing significant from 7.20% in August to 15.106% in September 2020 vs. the previous year.

Inflation rates have remained low and another interest rate cut could be on the cards. The improvement of the Rand against the dollar will also ensure that inflation is kept to a minimum giving more space for the SARB to reduce interest rates further. 2021 will be an interesting year for the real estate industry, we will see more supply from developers and many of the current payment holidays will come to an end for consumers that have been affected by the pandemic. The result will be a balanced supply and demand bringing the double-digit growth we have seen over the past two months to a more realistic growth percentage.

MultiNET’s business partner, Comcorp confirmed the price growth and has also seen a double-digit growth in approved home loans. Rademeyer says that even though many consumers have been affected by the Covid-19 virus, the banks are still finding ways to continue its lending mandate as well as stimulating the property industry. The average accepted approved bond has remained the same in 2020, whilst the number of home loans submissions have surged over 50%.

MJ Dafel and Gustav Kruger from propertycoza.co.za says that they have seen record numbers of sales being achieved by their offices and the low interest rate has most certainly contributed to the growth in the market.

Rademeyer says” Property price growth will slow in 2021 as more banks start easing payment holidays and a steady flow of housing stock becomes available in the market. Developers have seen the trend and are urgently trying to get new developments launched, the result will be that as more stock becomes available, house prices will become more competitive. We will continue to see growth in the housing market in the first 6 months whilst consumers take advantage of the low interest rates”.

For first time buyers, it important that they get sound advice and MultiNET Home Loans with our affiliate partners can assist with all their home loan requirements.

Head Office

Unit 1 Bush Hill Office Park, Jan Frederick Avenue, Randpark Ridge